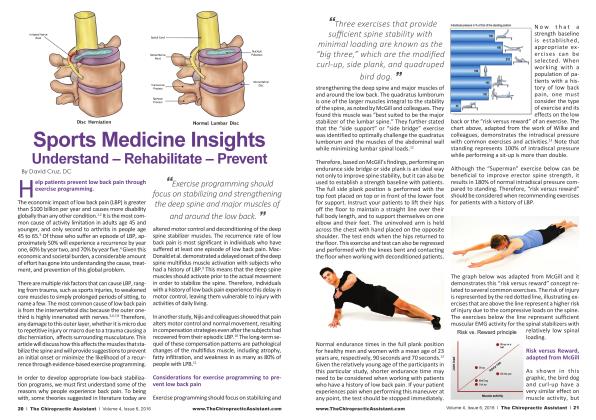

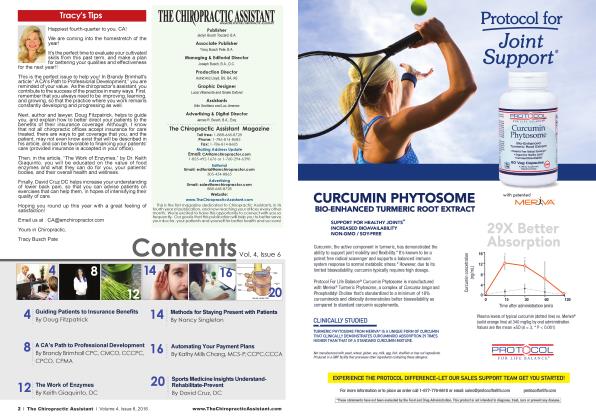

Guiding Patients to Insurance Benefits

Doug Fitzpatrick

The Problem Sometimes it seems that the gains made by treatment can be offset, at least in part, by the cost of care, the patient's time away from gainful employment, and the inconvenience of the treatment process. This is especially true for patients who are living "on the edge" financially.

What, if anything, can the physician do about it? Should healthcare providers assist patients by guiding them to insurance benefits and financial remuneration that may be available as a result of an injury? Flow proactive should a physician be in directing patients to benefits of which they may be unaware?

A Solution

Let me suggest a paradigm shift that could be a win-win for both patients and healthcare providers:

The intake process could include gathering specific and targeted information that directs the patient to sources of reimbursement for not only the doctor's fees, but also other compensation. Often, there are

Should healthcare providers assist patients by guiding them to insurance benefits and financial remuneration that may be available as a result of an injury ?”

substantial benefits available to patients that are overlooked. For instance, if your fees have been paid with a check or credit card, why shouldn't the patient also be reimbursed through the medical payment benefits of his or her auto coverage? And afteryourfees have been reimbursed to the patient, why shouldn't he or she also pursue compensation from the driver who caused the accident?

The "Double-Dipping" Dilemma

Consider the all-too-common fact pattern that frequently results in soft tissue injuries to motorists who find themselves in need of chiropractic care for relief. The patient (Driver #1) is stopped at a traffic light while running an errand for his employer. Fie has auto

The potient would need to communicate with the insurance companies to find out what the policies say about each insurer's

obligation to pay benefits. 39

coverage, which includes medical payment benefits. He also has health insurance. Driver #1 is rear-ended by another motorist (Driver #2) who is also on the job and distracted by an incoming text message. Driver #2 and his employer have automobile coverage.

What are the potential sources of reimbursement to the patient? 1) His medical pay coverage; 2) his health insurance; 3) workers' compensation benefits from his employer because the patient was on-the-job when the accident occurred; 4) Driver #2's auto liability insurance coverage; and 5) Driver #2's employer's liability coverage because Driver #2 was also on the job when the accident occurred.

The prospect of multiple recoveries from different insurance companies doesn't necessarily translate into payments from each, but it could. The patient would need to communicate with the insurance companies to find out what the policies say about

each insurer's obligation to pay benefits. Which company is primarily obligated to pay for the costs of treatment? Which is secondarily obligated? What are the rights of each company to reimbursement for benefits paid (i.e., subrogation)?

It may turn out, under our hypothetical, that the patient is entitled to recover two or three times for the cost of treatment. The prospect of multiple recoveries for the same charges is facetiously described by some claims adjusters as "doubledipping." The inference is that the patient is doing something dishonest by benefiting financially from the accident.

If doubleor triple-dipping is available because a motorist has purchased protection in the form of insurance or it is a benefit of employment, there is no reason why the patient should not receive those benefits and also pursue the party who caused the accident for additional compensation. If the injured motorist has acquired coverage from more than one source through the payment of premiums with hard-earned dollars, benefits should be paid in accordance with the policies notwithstanding protestations of "double-dipping" by claims adjusters.

Practice Tools to Help Patients

How grateful would your patients be if, as part of the intake process, you pointed them to benefits and insurance coverage about which they were unaware? How much goodwill would you generate if you helped patients find coverage to pay not only your fees, but also compensation above and beyond your fees?

It doesn't need to take significant time or energy to ask questions through the new-patient registration process, which will prompt the patient to identify insurance coverage and other sources of compensation that will mitigate the cost of treatment. A New Patient Benefits Inquiry form in PDF format can be downloaded for free at www.selfhelpautoclaims.com.

This publication is not intended to serve as a substitute for legal, tax, or other professional advice. Laws regarding insurance coverage, liability, and damages vary from state to state. If legal or other advice is required, the service of a qualified professional should be sought.

Doug Fitzpatrick, attorney and author, haspracticed law in Arizona ’s state and federal courts for 37 years. Fie has a general practice with an emphasis on representation of personal injury> and auto-claim victims, www.selfhelpautoclaims.com

View Full Issue

View Full Issue