Avoid Billing and Collecting Pitfalls with Medicare Patients

Kathy Mills Chang, MCS-P, CCPC, CCCA

Many chiropractors think they can "opt out" of Medicare. "Opting out" refers to the provider deciding not to bill Medicare at all, while simultaneously entering into private contracts with the Medicare beneficiaries they treat. Chiropractors are one of three service providers who may not opt out of Medicare, along with independent PTs and OTs. Chiropractors may decide to be participating or nonparticipating with Medicare, but they must have an active, valid Medicare provider number and may not opt out.

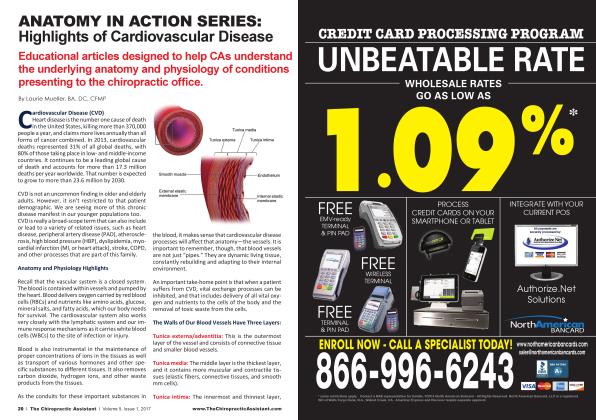

So how does this impact your Medicare patients? The only services ordered or delivered by a chiropractor that are covered under Medicare are the three spinal adjustment codes (98940, 98941, 98942). Every other service or product provided in the office is considered an "excluded service" and patients are expected to pay the doctor's actual feesforthese services. Examples include evaluation and management (E/M) services, X-rays, therapies, and durable medical goods. The status of the provider—whether participating or nonparticipating with Medicare—is irrelevant when it comes to these excluded services.

Knowing how and when to collect for services from Medicare patients is essential. The collection amount at the time of service depends on the par-

gtChiropractors may decide to be participating or nonparticipating with Medicare, but they must have an active, valid Medicare provider

number and may not opt out.33

ticipation status of the provider. To begin, when a Medicare patient receives an active treatment (AT) modifier-worthy spinal adjustment, the provider must submit the bill to Medicare on behalf of the patient. Participating Medicare providers may submit their actual fee for AT adjustments, but it is imperative they're mindful of the Medicare allowable fee for the three spinal CMT codes. Medicare will consider the allowable fee for the service, and if covered, pay it at 80%. To calculate the patient's 20% responsibility, you must be aware of the allowable fee. Any amount between the actual charge and Medicare's allowable fee is a mandatory writeoff. It is acceptable to collect this 20% coinsurance or any unmet annual deductible at the time of service. Your Medicare administrative contractor (MAC) website or interactive voice response (IVR) may be helpful in determining whether your patient's annual deductible is met. Mandatory fee reductions that are applied due to lack of participating in Medicare's Quality Programs or electronic

health record (EHR) incentives may not be collected from the patient.

Providers who do not participate with Medicare are obligated to charge no more than the limiting charge for the three spinal CMT codes. Medicare sets a nonparticipating allowable fee for these providers, which is lower than that allowance for participating providers.

The limiting charge is 115% of the allowable fee. It is an amount that will never Rep&rttvity' be recovered by the patient. Medicare will reimburse the patient directly for unassigned

services. While you may charge and collect the limiting charge, Medicare will consider only the nonparticipating allowable fee at 80% for covered services.

If the nonparticipating provider elects to accept assignment on a case-by-case basis, the maximum collectible amount is the nonparticipating allowable fee. Any amount above this fee is subject to mandatory write off.

it

If a patient is charged and billed correctly' he or she may be placed on a payment plan that is suitable

to your office processes. ”

Likewise, you may immediately collect for statutorily, noncovered services provided to Medicare patients during an office visit. Medicare does not currently provide guidance regarding these services, but does expect the patient to be charged and to pay for them. If a patient is charged and billed correctly, he or she may be placed on a payment plan that is suitable to your office processes. For example, the patient incurs costs of $15 per visit for electric muscle stimulation, in addition to their

“since you ore not allowed to routinely discount statutorily' noncovered services, such as exams, X-rays, therapies, and durable medical equipment, what

are your options?”

KeA.Mburi&m&nt

$6 coinsurance for the adjustment. Perhaps the patient can pay $25 a week toward his or her bill until the balance is zero. You have properly charged and billed the patient $21 a visit, but allow the patient's payments to be made toward the bill. Many offices find that patients are much more likely to follow a recommended treatment plan when payments can fit into their budget.

What about discounting services to Medicare patients? Business practices considered standard in other industries (such as discounts) may be considered kickbacks or inducements in health care. As such, there are definitive rules prohibiting providers from discounting or providing services for free, outside of documented financial hardship. Since you are not allowed to routinely discount statutorily, noncovered services, such as exams, X-rays, therapies, and durable medical equipment, what are your options?

• Option 1: Offer a 5 to 15% Time of Service Discount: Federal guidance dictates that a 5 to 15% discount off your actual fees may be appropriate when the patient pays promptly. You may elect to offer such a discount when statutorily, noncovered services are paid at the time of service.

• Option 2: Join a Discount Medical Plan Organization (DMPO) such as ChiroHealthUSA: My best recommendation is that providers join a DMPO. We

prefer ChiroHealthUSA. Medicare patients can join and enjoy these network-based discounts because they are "underinsured." This means that they are insured through Medicare for their covered adjustments, but notforthe other services. Providers can legally discount these services for members of the DMPO and offer lower fees, if desired. Patients can then pay these discounted fees for the services, either at the time of service or on a payment plan, as described earlier.

• Option 3: Have a Hardship Policy and Fee Schedule: Since most of the services rendered in a chiropractic office are not covered by Medicare, the financial burden falls to the Medicare patient. As you consider your hardship policy, it's essential to strengthen the validity of the policy with how you will verify hardship. Whether you are offering a hardship option to a Medicare patient who seeks relief for copayment and deductible, or for services not covered, this strong statement of your willingness to verify should indicate your commitment to fee-schedule compliance. The Office of the Inspector General (OIG) advises, "This hardship exception, however, must not be used routinely; it should be used occasionally to address the special financial needs of a particular patient. Except in such special

cases, a good faith effort to collect deductibles and copayments must be made." Any one of these three options will mitigate any risk of being penalized by the OIG, while meeting the needs of your Medicare patients.

As we know, chiropractic care has documentation requirements. The participating status of the provider is irrelevant to the documentation requirements. Nevertheless, collecting from Medicare patients for covered chiropractic manipulative treatment services and services that are never covered is manageable with increased knowledge and awareness about participating versus nonparticipating allowable fees, government guidelines, and practical collection options.

Kathy Mills Chang is a certified medical compliance specialist (MCS-P), a certified chiropractic professional coder (CCPC), and certified clinical chiropractic assistant (CCCA). Since 1983, she has provided chiropractors with reimbursement and

compliance training, advice, and tools to increase revenue and reduce risk, Kathy leads a team of 20 at KMC University and is considered one of our profession’s foremost experts on Medicare, documentation and compliance. She or any of her team members can be reached at 855-832-6562 or [email protected].

View Full Issue

View Full Issue