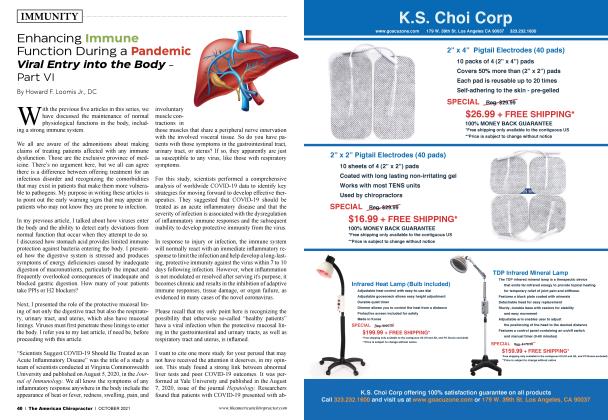

Securing and maintaining a profitable bottom line

October 1 2021 Karna Morrow, Gretchen BebbSecuring and maintaining a profitable bottom line

October 1 2021 Karna Morrow, Gretchen BebbReimbursement is the lifeblood of healthcare practitioners. The reimbursement process begins with new patient intake and ends with a claim payment or resolution. Successful reimbursement practices require a company-wide effort that includes a business culture consciously focused on managing the process. Here are some tips to help you minimize payment denials, maximize timely reimbursement, and manage the process of reimbursement.

It is important to recognize the roles that each person in the practice plays in reimbursement. The administrators, clinicians, billers, and managers are all responsible for critical tasks associated with service payments.

Administrator tasks set the stage by securing important details required for reimbursement. These tasks should minimally include:

• Reviewing the accuracy and completeness of new patient intake information. When the EHR provides an efficient way to gather key data, including but not limited to managing medical and indemnity coverage, the revenue cycle is off to a great start.

• Securing service verifications based on the patient’s insurance policy information. This information should include allowable codes for billing patient visits.

• Performing authorizations. A step beyond verifications, authorizations define how many treatments and manipulations are approved over a designated date range. Utilize the case management features within your EHR to consistently track the number of services performed against the authorization to avoid performing services outside the authorized amount.

• Reviewing reimbursement policies with each new patient. This conversation should include insurance policy information and patient financial responsibilities.

A new patient handbook that accompanies this conversation is a good way to educate patients about their role in the clinical and reimbursement processes.

• Creating a seamless way for the front desk staff to collect all copays and coinsurance at the time of the visit.

• Rescheduling all missed appointments and managing no-shows and late cancellations.

Clinician tasks involve professional, interactive patient care that is reflected with timely and detailed documentation. It should be completed and submitted for claims processing within 24 hours of the service. Documentation is the only way clinicians can prove the worth of their services to payers. Claims reviewers want to see:

• Accurate portrayal of clinical events reflecting differences from one service delivery session to the next.

• Specific clinical activities supporting codes used for billing. Logic example: “This procedure was provided to satisfy the patient’s disorder (clinical condition) by completing the following procedures and activities (listing activities) achieving this (result).”

• Documentation that reflects only and exactly the procedures performed and billed.

Clinicians should be proficient in utilizing the templates within their EHR to reduce redundancy in documentation while still providing patient encounter-specific information to support the medical necessity.

Biller tasks are mission-critical for controlling the accuracy and timeliness of billed charges. Procedures to follow should include:

• Reviewing the accuracy of the patient’s demographic and insurance information before billing.

• Entering or reviewing codes submitted for billing on clinician documentation.

Note: Claims should never be submitted without the proof contained in a clinical note.

• Submitting claims that accurately include modifiers with CPT codes.

• Filing clean claims.

• Providing accurate, timely report information about aged receivables, outstanding claims, and payment denials.

• Using an EHR that supports each step of the billing process.

Consider a case management approach to claims management to track the number of authorizations to reduce free care.

Manager tasks help create the clockwork efficiencies that control reimbursement success. Managers should pay attention to all business numbers. Those numbers will not lie about the financial health of your practice.

• Review and understand the status of claims each week to determine 1) what and why claims are outstanding; 2) where and why claims are being held up; and 3) what and why claims have been denied.

Each one of these items deserves a weekly action plan to keep reimbursement flowing. This plan should be recorded and discussed with the staff.

Invite your biller to participate in these meetings.

• Conduct a monthly (minimum quarterly) overview of company financial status as it relates to internal reimbursement processes, expectations, and individual payer response.

Develop necessary action plans.

• Develop and rely on company policies and procedures to improve staff understanding and adherence to the activities of reimbursement associated with each job description.

Perform timely staff performance reviews.

Create an incentive program for good work.

• Review and understand dashboard information to seize the opportunity to review available statistics.

• Manage outside billers and vendors using well-defined policies and procedures specific to your practice.

• Manage contractual relationships with payers annually or as needed.

Truly successful reimbursement involves using process strategies that begin with new patient intake and extend to receipt of payments for services. A key to success is to clarify and define the roles and responsibilities of each employee as those activities relate to the reimbursement process and practice’s financial goals. Managing the outcome of those roles and responsibilities helps secure a profitable bottom line.

Kama Morrow, CPC, RCC, CCS-P, is the client services director for Practice EHR. She has spent nearly three decades in the industry leading electronic health record (EHR) implementations and providing consulting and training for a variety of healthcare organizations. Morrow is a frequent contributor to highly regarded industry publications and national conferences, providing insights on practice management, coding, billing, and other industry-related topics.

Gretchen Bebb, M.S., CCC-SLP, M.M. is the allied health services manager for Practice EHR. In her role at Practice EHR, she focuses on expanding Practice EHR's allied health service offerings. With more than 30 years in the allied health space, Gretchen uses her experience and service on numerous industry associations to stay aligned to the challenges and trends impacting clients. For more information about Practice EHR, email [email protected], visit www.practiceehr.com, or call 469-305-7171.

View Full Issue

View Full Issue