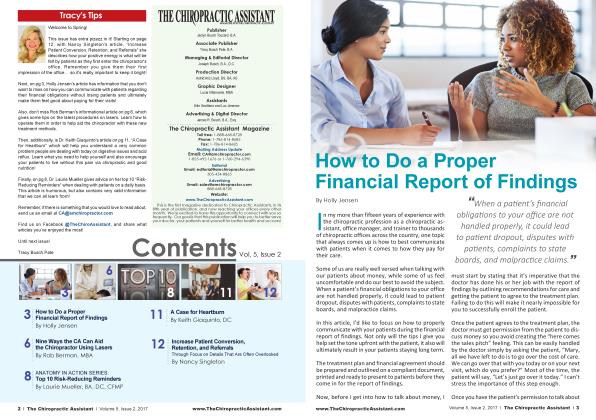

How to Do a Proper Financial Report of Findings

Holly Jensen

In my more than fifteen years of experience with the chiropractic profession as a chiropractic assistant, office manager, and trainer to thousands of chiropractic offices across the country, one topic that always comes up is how to best communicate with patients when it comes to how they pay for their care.

Some of us are really well versed when talking with our patients about money, while some of us feel uncomfortable and do our best to avoid the subject. When a patient's financial obligations to your office are not handled properly, it could lead to patient dropout, disputes with patients, complaints to state boards, and malpractice claims.

In this article, I'd like to focus on how to properly communicate with your patients during the financial report of findings. Not only will the tips I give you help set the tone upfront with the patient, it also will ultimately result in your patients staying long term.

The treatment plan and financial agreement should be prepared and outlined on a compliant document, printed and ready to present to patients before they come in for the report of findings.

Now, before I get into how to talk about money, I

“When a patient's financial obligations to your office are not handled properly, it could lead to patient dropout, disputes with patients, complaints to state boards, and malpractice claims.33

must start by stating that it's imperative that the doctor has done his or her job with the report of findings by outlining recommendations for care and getting the patient to agree to the treatment plan. Failing to do this will make it nearly impossible for you to successfully enroll the patient.

Once the patient agrees to the treatment plan, the doctor must get permission from the patient to discuss money so you avoid creating the "here comes the sales pitch" feeling. This can be easily handled by the doctor simply by asking the patient, "Mary, all we have left to do is to go over the cost of care. We can go over that with you today or on your next visit, which do you prefer?" Most of the time, the patient will say, "Let's just go over it today." I can't stress the importance of this step enough.

Once you have the patient's permissiontotalkabout

money, the doctor should warm up the patient and introduce the CA coming intothe room to reviewthe cost of care. The doctor should say, "Mary, I'm going to have Amber come in and review our program with you. I want to let you know that you don't have to do the payment plan that Amber reviews with you since we have other options, but I highly recommend that you use it because it covers everything I recommended and will save you the most money."

Once the patient agrees to care, has given permission to talk about money, and has been warmed up to the CA coming in to go over finances, we can proceed to the CA reviewing the finances.

You should have a private area to discuss financial plans with the patient to ensure privacy and keep the patient comfortable, although it's likely the patient is already in a private room for the clinical report of findings. Do not discuss this at the front desk. In my experience, it's best to use a "matter of fact" tone when outlining the cost of care. You also want to keep it simple. The more details and numbers you start spouting off in the beginning of the conversation, the more you will leave the patient feeling overwhelmed.

With your compliant financial plan in hand, you're

going to stick to reviewing the total cost of care, point out any savings the patient will get by enrolling into the care plan, and reviewthe payment options.

Here's an example of how this would go: "Mary, I'm so glad the doctor found he could help you! Based upon the doctor's recommendations, we've outlined the following all-inclusive program of care. If you were to pay per visit, the total cost of care comes to $X. However, by enrolling in this program, it covers everything and saves you the most money." This is a good spot to pause and just get confirmation from the patient with a nod of the head.

Continue by saying, "Mary, we can take that total you see here, and you have three choices on how to pay. Our first option is monthly payments. Our second option, which most of our patients choose, is a down payment followed by smaller monthly payments. And finally, if you prefer, our third option is to pay in full. Mary, before I go any further through the plan, which of these options do you feel works best for you?"

By giving your patients a choice, they don't feel pressured. They really appreciate the options and letting them choose. You may wonder why I said "which most of our patients choose" for the second option. It's simply because it's the best option for committing them to care as well as making it easy to transition them to their next program. I'll explain more in future articles.

Once patients have chosen the payment option that works best for them, they're pretty much committing themselves to the program. Before reviewing the details of howthe program works, I recommend handling the most common objections the patients may have. Typically, people want to know what happens if they miss an appointment and what happens if they need to stop care early.

That part of the conversation may go something like this: "Mary, I'm glad to hear you'll be choosing option two. Before I review the details of the program, let me answer the two most common questions we get from our patients. One is what happens if you go on vacation and miss appointments. Rest assured, you're not going to lose that time. We will extend the program to allow you to make up those missed visits.

"The second question is what if you need to stop the program early. Mary, you can stop the program at anytime. You're not locked into this. Just simply let us know and we will prorate the program for the care you've used. If you've paid us more than

what you've used, we will happily issue a refund. If you've paid less, you would simply pay the balance for the care you used, not forthe entire program."

After you've addressed those two most common objections, you can move forward outlining the rest of the plan's details.

The last thing you'll do is review the payment policy. Let patients know that because they're choosing a recurring payment option, you require them to leave their billing information on file and their payment will be automatically deducted. (Be sure that you're using a PCI DSS-compliant program for storing billing information!) Answer any final questions patients may have, gathertheir billing details, and enroll them into the program. Keep a signed copy of the financial plan on file and give patients a copy for their records.

We can now cross each item off the list below when it comes to doing a proper financial report of findings:

• After agreeing on a treatment plan, the doctor asks for permission to talk about finances.

• In a private room, review the compliant financial plan while pointing out the savings.

• Give payment options.

• Review how the program works, keeping it simple, and address common questions.

• Review the payment policy.

• Enroll the patient in care.

You should find that when you follow the steps that I've outlined in this article you will get more patients saying "yes" to care, ultimately increasing patient retention and overall collections while drastically decreasing those awkward financial conversations with patients.

’jf^i About the author: Holly Jensen has served the chiropractic profession for 15+ years as a CA and iV °ffice Manager to Dr. Miles Bodzin, Founder & »CEO of Cash Practice® Systems. For the past decade she has served as the Director of Operations for Cash Practice® Systems where she has trained thousands of DC ’s and CA's on how to run a cash-based practice. Cash Practice® Systems offers web based software for chiropractors to implement a 4-step process resulting in increased patient retention. The Wellness Score®, Cash Plan Calculator®, Auto-Debit System®, and Drip-Education Email® Marketing System which all work together to help free a doctor from insurance dependence. For more information, visit www.CashPractice.com. Holly may be contacted at 877343-8950 or [email protected]

View Full Issue

View Full Issue